Life Insurance in and around Two Harbors

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

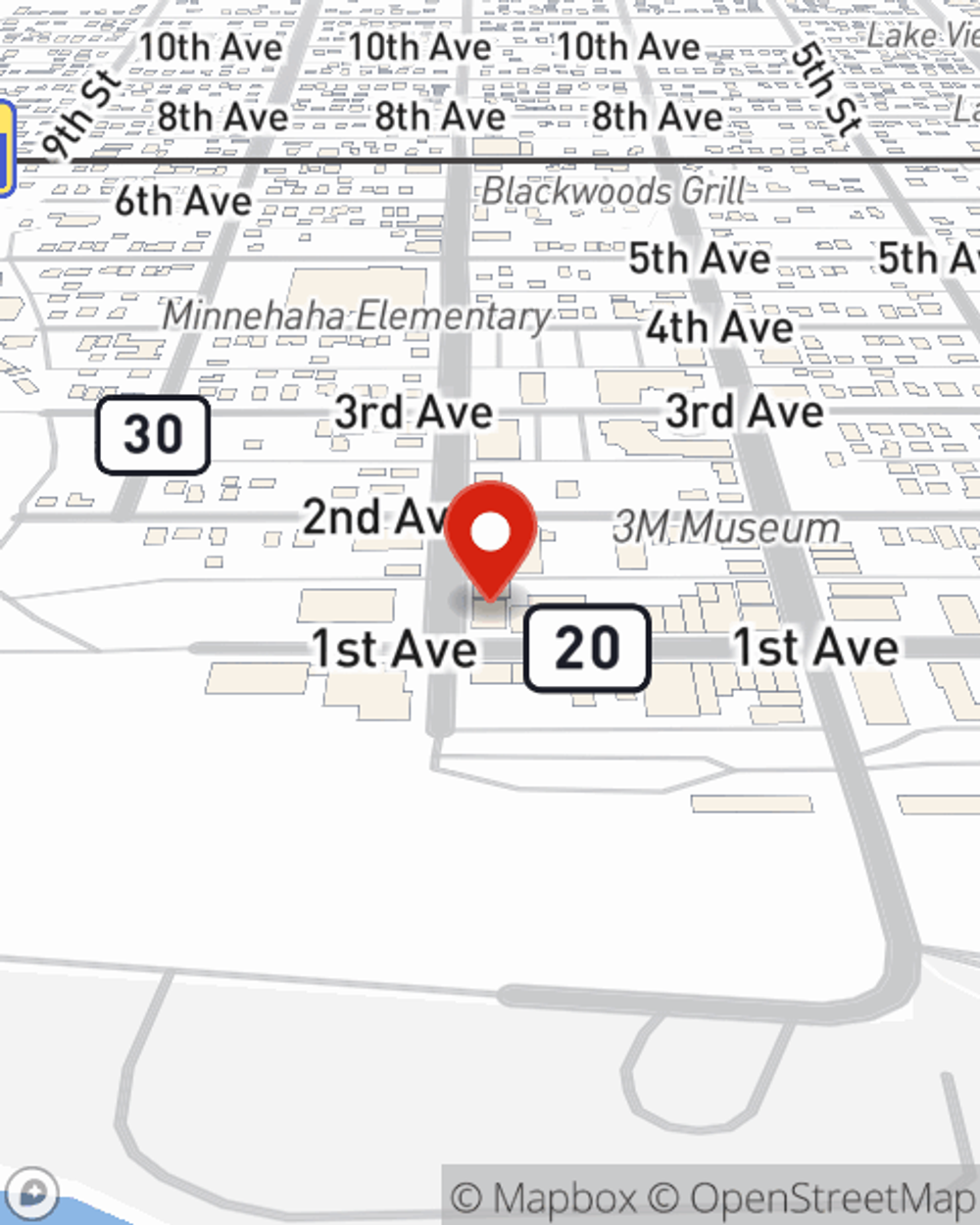

- Two Harbors

- Duluth

- Silver Bay

- Grand Marais

- Hibbing

- Finland

- Schroeder

- Tofte

- Grand Portage

- Knife River

- Lutsen

- Cloquet

- Beaver Bay

- Ely

- Carlton

- Eveleth

- Wrenshall

- Proctor

- Saginaw

- Barnum

- Isabella

Be There For Your Loved Ones

When it comes to reliable life insurance, you have plenty of choices. Evaluating coverage options, providers, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Amy Jordahl is a person committed to helping you create a policy for your specific situation. You’ll have a no-nonsense experience to get reasonably priced coverage for all your life insurance needs.

Get insured for what matters to you

What are you waiting for?

Two Harbors Chooses Life Insurance From State Farm

When applying for how much coverage is right for you, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, how healthy you are, and perhaps even lifestyle and gender. With State Farm agent Amy Jordahl, you can be sure to get personalized service depending on your individual situation and needs.

To check out what State Farm can do for you, call or email Amy Jordahl's office today!

Have More Questions About Life Insurance?

Call Amy at (218) 834-2353 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Amy Jordahl

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.